Stay NJ Property Tax Relief Program

Informational Summary for New Jersey Homeowners

What is Stay NJ?

Stay NJ is a new property tax relief program designed to help eligible New Jersey senior and disabled

homeowners reduce their property tax burden. The program offers substantial credits to qualifying homeowners

who meet specific age, income, and residency requirements.

Eligibility Criteria

To qualify for Stay NJ, applicants must meet the following:

• Own and occupy their New Jersey home as their principal residence.

• Be age 65 or older (or receiving Social Security Disability benefits).

• Have gross income under $500,000.

• Not reside in a mobile home.

• File the combined application (PAS■1) for Stay NJ, ANCHOR, and Senior Freeze.

Program Benefits

Eligible homeowners may receive up to 50% of their property tax bill, capped at $6,500 for tax year 2024. The

Stay NJ credit is coordinated with other state property tax relief programs to provide the maximum possible

benefit.

Application & Deadlines

The single combined application (Form PAS■1) is due October 31, 2025 for tax year 2024. Payments are

expected to begin in early 2026

Important Notes

updated by the state. Homeowners should monitor official New Jersey Treasury communications for the latest

details.

Action Steps

To prepare for the Stay NJ application:

• Confirm your age, income, and homeownership status.

• Gather proof of ownership and income documentation.

• Mark your calendar for the October 31, 2025 deadline.

• Consult your tax advisor for guidance on your specific situation.

Additional Information

For full details, visit the New Jersey Division of Taxation website at www.nj.gov/treasury/taxation/staynj. Our

firm will continue to provide updates as new information becomes available.

Prepared by Whale, Mallozzi & Padgett, PC | For informational purposes only

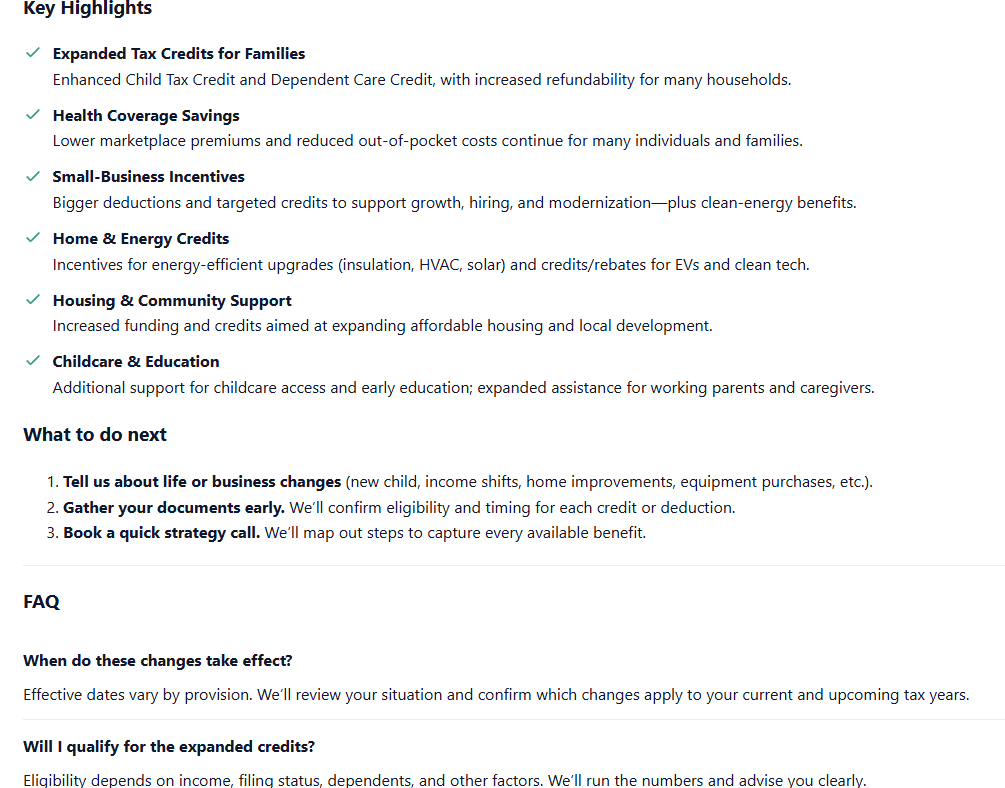

Big Beautiful Bill - Key Highlights

New Client Portal - Canopy

We’ve Moved to a New Client Portal: Canopy

To better serve you with faster, more secure, and user-friendly technology, we are no longer using the Thomson Reuters/NetClient CS portal.

Our firm has officially transitioned to the Canopy Client Portal for all document sharing, e-signature requests, tax organizers, invoices, and secure messaging.

🔐 What This Means for You

You will no longer access your documents or upload tax information through the old Thomson Reuters portal.

All client activity will now take place through Canopy.

🚀 How to Access the Canopy Portal

You will receive (or may have already received) an email invitation from us through Canopy. Here’s what to do:

✅ If This is Your First Time Logging In:

- Open the email invitation from our firm via Canopy.

- The subject line will reference “Client Portal Invitation” or “Access Your Account.”

- Click the secure link in the email to set up your account.

- Create your password when prompted.

- Once your account is set up, you can log in anytime at:

👉 https://app.canopytax.com/client-portal

✅ If You’ve Already Set Up Your Account:

You can log in directly by going to:

👉 https://app.canopytax.com/client-portal

Use your email and password to access your portal.

📲 Mobile Access (Optional but Recommended)

Canopy also offers a free mobile app:

- Search “Canopy Client Portal” in the App Store (iPhone) or Google Play (Android).

- Log in using the same email and password.

⚠️ Need a New Invitation or Didn’t Receive the Email?

Just call our office or send us a quick message, and we’ll resend your portal link right away.

✅ What You Can Do in the New Portal:

- Securely upload tax documents

- Sign forms electronically

- View completed returns and prior-year documents

- Receive and send secure messages

- Pay invoices and view statements

We appreciate your cooperation during this transition and are confident you will find the Canopy portal easier, faster, and more convenient.

If you need assistance getting logged in, please contact our office—we’re happy to help!

Get to Know the Document Retention Guide

Storing tax records: How long is long enough?

April 15 has come and gone, and another year of tax forms and shoeboxes full of receipts is behind us. But what should be done with those documents after your check or refund request is in the mail?

Federal law requires you to maintain copies of your tax returns and to support documents for three years. This is called the "three-year law" and leads many people to believe they're safe, provided they retain their documents for this period.

However, if the IRS believes you have significantly underreported your income (by 25 percent or more), it may go back six years in an audit. If there is any indication of fraud or you do not file a return, no period of limitation exists. To be safe, use the following guidelines.

Business Documents To Keep For One Year

- Correspondence with Customers and Vendors

- Duplicate Deposit Slips

- Purchase Orders (other than Purchasing Department copy)

- Receiving Sheets

- Requisitions

- Stenographer's Notebooks

- Stockroom Withdrawal Forms

Business Documents To Keep For Three Years

- Employee Personnel Records (after termination)

- Employment Applications

- Expired Insurance Policies

- General Correspondence

- Internal Audit Reports

- Internal Reports

- Petty Cash Vouchers

- Physical Inventory Tags

- Savings Bond Registration Records of Employees

- Time Cards For Hourly Employees

Business Documents To Keep For Six Years

- Accident Reports, Claims

- Accounts Payable Ledgers and Schedules

- Accounts Receivable Ledgers and Schedules

- Bank Statements and Reconciliations

- Cancelled Checks

- Cancelled Stock and Bond Certificates

- Employment Tax Records

- Expense Analysis and Expense Distribution Schedules

- Expired Contracts, Leases

- Expired Option Records

- Inventories of Products, Materials, Supplies

- Invoices to Customers

- Notes Receivable Ledgers, Schedules

- Payroll Records and Summaries, including payment to pensioners

- Plant Cost Ledgers

- Purchasing Department Copies of Purchase Orders

- Records related to net operating losses (NOL's)

- Sales Records

- Subsidiary Ledgers

- Time Books

- Travel and Entertainment Records

- Vouchers for Payments to Vendors, Employees, etc.

- Voucher Register, Schedules

Business Records To Keep Forever

While federal guidelines do not require you to keep tax records "forever," in many cases there will be other reasons you'll want to retain these documents indefinitely.

- Audit Reports from CPAs/Accountants

- Cancelled Checks for Important Payments (especially tax payments)

- Cash Books, Charts of Accounts

- Contracts, Leases Currently in Effect

- Corporate Documents (incorporation, charter, by-laws, etc.)

- Documents substantiating fixed asset additions

- Deeds

- Depreciation Schedules

- Financial Statements (Year End)

- General and Private Ledgers, Year End Trial Balances

- Insurance Records, Current Accident Reports, Claims, Policies

- Investment Trade Confirmations

- IRS Revenue Agent Reports

- Journals

- Legal Records, Correspondence and Other Important Matters

- Minutes Books of Directors and Stockholders

- Mortgages, Bills of Sale

- Property Appraisals by Outside Appraisers

- Property Records

- Retirement and Pension Records

- Tax Returns and Worksheets

- Trademark and Patent Registrations

Personal Documents To Keep For One Year

While it's important to keep year-end mutual fund and IRA contribution statements forever, you don't have to save monthly and quarterly statements once the year-end statement has arrived.

Personal Documents To Keep For Three Years

- Credit Card Statements

- Medical Bills (in case of insurance disputes)

- Utility Records

- Expired Insurance Policies

Personal Documents To Keep For Six Years

- Supporting Documents For Tax Returns

- Accident Reports and Claims

- Medical Bills (if tax-related)

- Sales Receipts

- Wage Garnishments

- Other Tax-Related Bills

Personal Records To Keep Forever

- CPA Audit Reports

- Legal Records

- Important Correspondence

- Income Tax Returns

- Income Tax Payment Checks

- Property Records / Improvement Receipts (or six years after property sold)

- Investment Trade Confirmations

- Retirement and Pension Records (Forms 5448, 1099-R and 8606 until all distributions are made from your IRA or other qualified plan)

Special Circumstances

- Car Records (keep until the car is sold)

- Credit Card Receipts (keep until verified on your statement)

- Insurance Policies (keep for the life of the policy)

- Mortgages / Deeds / Leases (keep 6 years beyond the agreement)

- Pay Stubs (keep until reconciled with your W-2)

- Sales Receipts (keep for life of the warranty)

- Stock and Bond Records (keep for 6 years beyond selling)

- Warranties and Instructions (keep for the life of the product)

- Other Bills (keep until payment is verified on the next bill)

- Depreciation Schedules and Other Capital Asset Records (keep for 3 years after the tax life of the asset)

Tax Preparation Document Checklist

Personal information for each family member:

Full Name

Date of Birth

Social Security Card/TIN

Proof of Medical Insurance for the family (Form 1095 A/B/C)

Current Bank Information (Routing & Account Number)

Last Year's Tax Return Federal & State (New clients only)

Income and Tax Information:

W-2's

Interest (Form 1099-DIV or substitute)

Dividend (Form 1099-DIV or substitute)

Stock Sales (Form 1099-B or Broker Statement)

Pension & Annuity Income (Form 1099-R)

IRA or 401(K) Distribution Form ((Form 1099-R)

Social Security or Railroad Retirement (SSA-1099 or RRB-1099)

Self-Employment Income & Expenses

Miscellaneous Income (Form 1099-MISC)

Rental Income & Expenses

Sale of a Personal Residence (HUD Statement and/or Form 1099S)

Schedule K-1's from Corp., Partnerships, Invesments,

Sale of Business Assets

Gambling or Lottery Winnings (W-2G)

Unemployment Compensation (Form 1099-G) Download from State' DOL Website

Alimony- Copy of Divorce decree

Estimated Taxes Paid- Copies of checks

IRS Notices (if any)

Income and Tax Information:

Medical Expenses

Real Estate Taxes

Mortgage Interest (Form 1098)

Charitable Contributions (cash and non-cash)- copies of receipts/cancelled checks

Traditional IRA Contributions/Roth IRA

Student Loan Interest Form (Form 1098E)

Higher Education Expenses-(Form 1098 T- Download from student's portal)

Child Care Expenses- Provider's name, address, & tax id number

Gathering Records Is The First Step Of Tax Preparation

Taxpayers should start gathering and organizing records to get ready for filing their 2024 federal tax return. They need all year-end income documents to help ensure they file a complete and accurate 2024 federal tax return and avoid refund delays.

Documents

Taxpayers should have all necessary records handy, such as W-2s, 1099s, receipts, canceled checks and other documents that support any income, deductions or credits reported on their tax return.

Most taxpayers should receive income documents including:

- Forms W-2, Wage and Tax Statement.

- Form 1099-MISC, Miscellaneous Income.

- Form 1099-INT, Interest Income.

- Form 1099-NEC, Nonemployee Compensation.

- Form 1099-G, Certain Government Payments – such as unemployment compensation or state tax refund.

- Form 1095-A, Health Insurance Marketplace Statements.

IRS Online Account

An IRS Online Account makes it easy for taxpayers to quickly get the tax planning info they need. With an IRS Online Account, they can:

- View key details from their most recent tax return, such as adjusted gross income.

- Request an Identity Protection PIN.

- Get account transcripts to include wage and income records.

- Sign tax forms like powers of attorney or tax information authorizations.

- View and edit language preferences and alternative media.

- Receive and view notices and letters.

- View, make and cancel payments.

We’d love to hear from you! Call our friendly team on (732) 945-5995